excise tax ma pay

Various percentages of the manufacturers list price are applied as. A vehicles excise valuation is based on the manufacturers list price MSRP in the vehicles year of manufacture.

Motor Vehicle Excise Marshfield Ma

Credit Debit Cards.

. Learn if your corporation has nexus in. 295 100 minimum Excise Tax. If you dont make your payment.

Learn how to pay for various Easthampton services. Excise Personal Property Tax Bills and Parking Tickets Online. Payment at this point must be made through our Deputy Collector Kelley.

We recommend keeping a copy of the confirmation number with your tax records. It is charged for a full calendar year and billed by the community where the vehicle is usually garaged. If you have problems completing an online tax payment please use our online Tax Help form to request assistance.

Easy to use - No registration required. Payment of the motor vehicle excise is due 30 days from the date the excise bill is issued not mailed as is popularly believed. Online Bill Payment in partnership with City Hall Systems offers the following.

Massachusetts imposes a corporate excise tax on certain businesses. Tax Department 617 887-6367 Toll-free in Massachusetts 800 392-6089 9 am4 pm Monday through Friday more contact info Filing Requirements Generally all. Payable in full within 14 days from the.

Turners Falls MA 01376. Credit or Debit card payments will clear within 30 minutes. Who must pay excise tax.

Registry of Motor Vehicles 355 Middlesex Avenue Wilmington MA 01887 Excise tax is due and payable within thirty days of the date of issue. The excise rate is 25 per 1000 of your vehicles value. Pay City Clerk Payments Online.

If youre making a credit card payment regarding a bank or wage levy you must contact us at 617 887-6367. Motor Vehicle Excise Information Motor Vehicle Excise FAQs Current Fiscal Year Tax Rate Motor Vehicle Excise Tax Online Payments Request for Tax Information Municipal Lien Certificate. Electronic Check payments will clear in 2 weeks.

Corporate excise can apply to both domestic and foreign corporations. Online Payments Available payment options vary among services and our online payment partners. Pay CURRENT FISCAL YEAR Springfield Taxes and Fees.

It applies to anyone who registers a motor vehicle in Massachusetts. 413 863-3200 ext 120. The excise rate is 25 per 1000 of your vehicles value.

If you are unable to find your bill try. Access view and pay your bills online at your convenience. License Bill Type Parking Find your bill using your license number and date of birth.

Skip to Main Content. How to file an excise tax abatement Need to Know. According to Chapter 60A section 2.

To avoid added interest and penalties payment. To find out if you qualify call the Taxpayer Referral and Assistance Center at 617-635-4287. How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal.

Please select a search method using one of the following options. Tax on Property vehicles. Clicking the payment of choice will display the available options and any associated.

It is charged for a full calendar year and billed by the community where the vehicle is usually garaged. A flat 1000 charge to the bill plus interest at the rate of 12 per annum from the due date to the date of payment. Also under MGL Chapter 59 Section 2 it is important to.

Under MGL Chapter 60A all Massachusetts residents who own and register a motor vehicle must annually pay a motor vehicle excise. ATL - Lates Tax Financial News Updates.

National Weir Co Massachusetts Corporate Excise Tax Statement Provincetown History Preservation Project

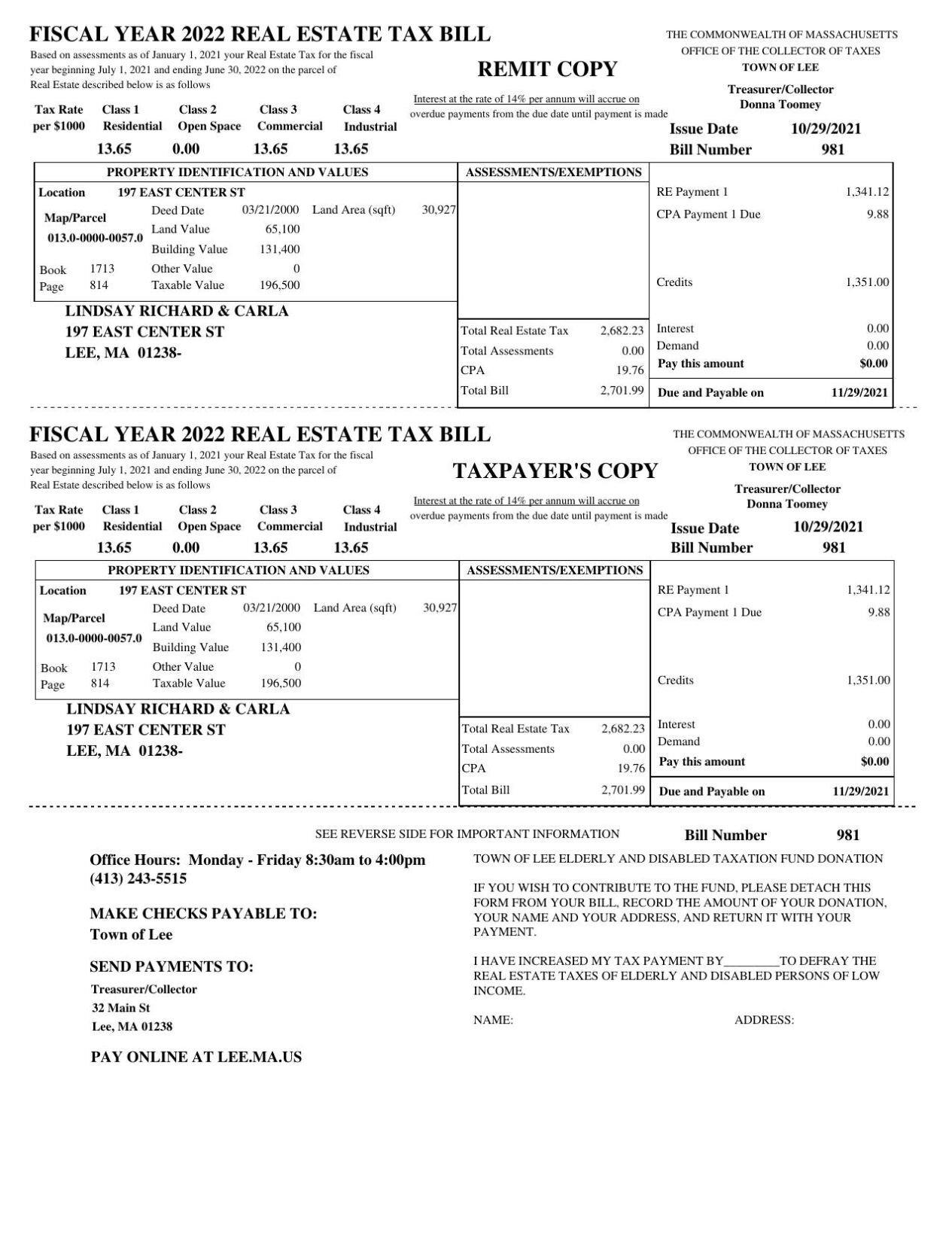

6 Things To Know About Your Property Tax Bill If You Own A Home In Berkshire County Local News Berkshireeagle Com

Treasurer Collector Town Of Montague Ma

How To Pay Your Motor Vehicle Excise Tax Boston Gov

Motor Vehicle Excise Tax Bills Leicester Ma

City Of Lowell Ma Government Motor Vehicle Excise Tax Bills For The 2021 Tax Year Have Been Mailed And Are Due On 3 25 2021 Please Call The Collector S Office If You

Corporate And Other Business Excise Description

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov

Motor Vehicle Excise Tax Bills Gardner Ma

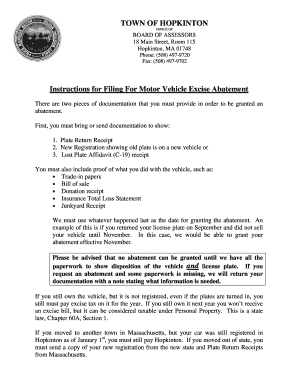

Hopkinton Town Ma Tax Collector Fill Online Printable Fillable Blank Pdffiller

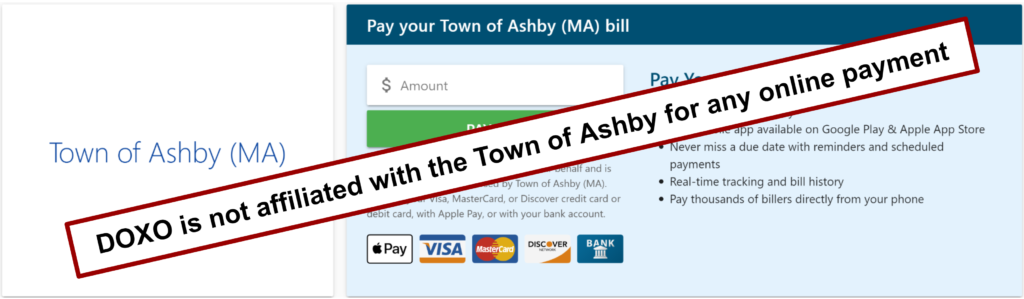

Online Bill Payment Hingham Ma

How High Are Spirits Excise Taxes In Your State

Online Bill Payment Town Of Dartmouth Ma

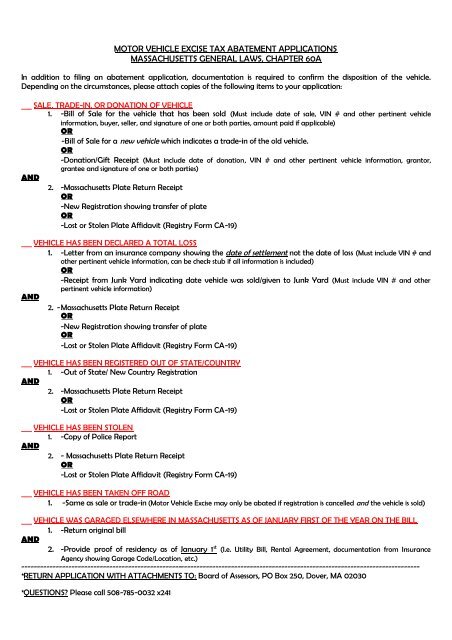

Motor Vehicle Excise Tax Abatement Applications Massachusetts

Motor Vehicle And Boat Tax Boston Gov

Massachusetts Lawmakers Mull Doubling Alcohol Excise Tax Across All Categories Brewbound

.jpg)